What is Section 8 housing in Michigan: [Best Explained]

Welcome to my blog exploring the ins and outs of the Section 8 housing program. Now I would like to look at what is Section 8 housing in Michigan.

What exactly will you find here?

- What does the Section 8 Housing Program include, why is it so important to residents, and how does it work specifically in Michigan?

- What are the benefits and limitations of Section 8 participation for program participants?

- We will also consider the prospects and my personal successful cases in solving housing problems in Michigan under Section 8.

My goal now is to provide you with comprehensive information that will increase opportunities and understanding for both applicants and program stakeholders.

Join me as we take a journey to uncover the nuances of Michigan’s Section 8 housing program and explore how it impacts lives and communities across the state. Whether you are a potential applicant, a landlord interested in participating, or simply curious about this vital program, we invite you to follow along and learn about the transformative impact of affordable housing initiatives in Michigan.

Read also: How Long Can Someone Stay With You On Section 8?

How Does the Section 8 Program Work in Michigan?

For my clients, Michigan’s Section 8 housing program seems like a complicated process from the very beginning. Therefore, for me, as a specialist, it is important to explain its mechanisms already at the first meeting.

And it doesn’t matter who the tenant or landlord is, you need to separate all the nuances and explain it to each person, and this is what I would like to do for you today. In this section, we’ll look at the inner workings of the state’s program, including eligibility requirements, the application process, and the key role of local governments and agencies.

Qualification requirements for participation in Section 8

Individuals and families must meet certain eligibility criteria to qualify for the Section 8 program in Michigan. For convenience, I have briefly highlighted them in the table.

| Aspect | Description |

|---|---|

| Citizenship | Michigan Section 8 rental assistance is only available to citizens of the U.S. and legal aliens. You must provide citizenship documents during the application process for Section 8. |

| Family Status | Your household must meet the program’s definition of a family to be eligible for the Housing Choice Voucher under Section 8. Failure to meet this definition will result in ineligibility for assistance. |

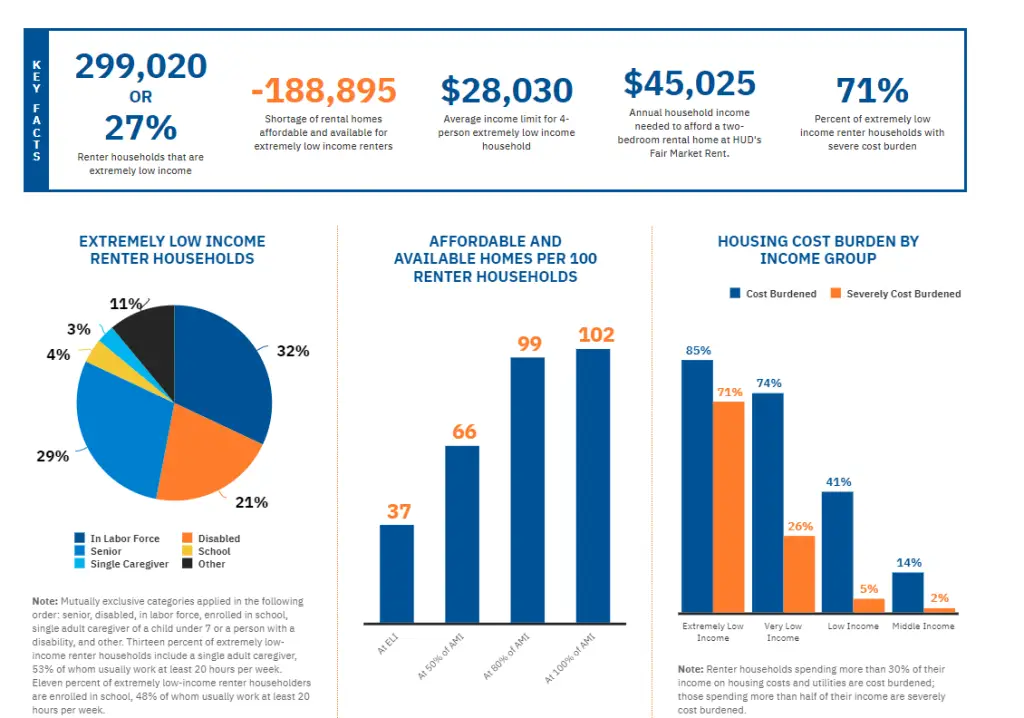

| Income Eligibility | To qualify for Section 8 assistance in Michigan, your household income must fall within the income limits determined by HUD. Details regarding these income limits can be found here. |

| Criminal Background | All members of the household must pass a criminal background check to be eligible for the Michigan Section 8 Housing Choice Voucher program. Failure to pass this check may result in ineligibility for assistance. |

Section 8 Housing in Michigan: Application Process and Selection of Participants

If you’ve reviewed all the information and are ready to apply for the Section 8 program, proceed with the following steps.

First, you must apply to your city’s local housing authority. All participants are placed on a specific waiting list. You can view the Section 8 Michigan open list for your city and see how the situation is progressing. I would like to note that the length of the MSHDA Section 8 list may vary depending on demand and available funding.

Then, when it is your turn, you will be checked by the relevant authorities regarding suitable, and after the meeting, you can receive a housing selection voucher, which you can use to find suitable rental housing on the private market.

Not only tenants but also landlords who are interested in participating in the program go through such a long journey. They also have their criteria, I talked about this a little earlier.

Benefits and Drawbacks of participation in the Michigan Section 8 program

I would like you to understand that participation in the Section 8 program provides significant benefits to eligible individuals and families in Michigan. But despite the bright prospects, you must be prepared for certain restrictions and problems. Let’s look at these aspects in detail.

Pros

- Section 8 is a great program that provides affordable housing for low-income individuals and families by subsidizing a part of their rental payment.

- Another advantage is that participants can choose their own housing according to their preferences, rather than being assigned one without consideration for their preferences.

- The program provides housing stability as long as participants comply with program requirements and rules.

- Section 8 vouchers allow families, especially those with children, to live in safer neighborhoods that they might not otherwise be able to afford.

- Possibility of homeownership. For me, this is just an incredible plus. After all, sometimes the program covers even mortgage loans. And so you can live in your own home over time.

Cons

- Demand for Section 8 vouchers often outstrips supply, resulting in lengthy waiting lists in many areas.

- Not all landlords accept Section 8 vouchers, which may limit housing options in specific regions.

- Participants must meet income requirements, which may exclude some individuals or families.

- Properties must meet certain housing quality standards, which may limit options in certain areas.

- Application and recertification processes can be bureaucratic and time-consuming, resulting in delays and frustration among participants.

How Section 8 in Michigan Changes Lives: My Client’s Story

3 years ago I was living and working in Grand Rapids, Michigan. Sarah contacted me. The woman at that time was 35 years old and had 3 children and a very terrible family life. Now, as I write ‘family,’ I even doubt whether it was accurate because essentially there was no family there. She finally found the strength to escape an abusive relationship and tried to find safe and stable housing for herself and her children.

With limited resources and limited knowledge, Sarah approached me and we applied for the Section 8 program. Quickly enough, her application was approved, this was a sign that Sarah had a happy future ahead of her. It was a moment of relief and hope for Sarah and her family.

With the help of a Section 8 voucher, Sarah got a modest but safe apartment in a quiet area. For the first time in years, she and her children had a place to call home, free from the fear and uncertainty they had experienced in the past.

But the journey didn’t end there; as a member of Section 8, Sarah faced her own challenges. I heard many stories from her about discrimination from landlords and often complex program requirements. I helped her in moments when she felt depressed. And thanks to constant support, protection, and her own inner strength, Sarah survived.

Today, Sarah is no longer the frightened woman I met at the beginning. She has found a stable job, her children are doing well in school, and she has even become an advocate for other victims of domestic violence. I am proud of these women because Sarah’s story is a testament to the importance of programs like Section 8 that provide a lifeline to those in need and empower them to rebuild their lives.

My Opinion on the Problems and the Future of the Section 8 Program in Michigan

Therefore, having my experience working in Michigan and communicating with colleagues, I can conclude that stigma is a very common problem. Tenants face discrimination and mistrust, even if they are single mothers with children.

I understand that landlords may have often encountered untrustworthy people and fear for their property, but I also understand women who have experienced domestic violence and who seek help and are turned away. In this case, I am ready to defend their rights day and night to give them that straw of hope and show them that life is not over.

Because such discrimination not only limits housing options but also perpetuates cycles of poverty and inequality.

Another problem is the long waiting lists for Section 8 assistance. In Michigan, as in many other states, individuals and families can wait months or even years for their applications to be approved. During this time, they are often left without stable housing, which adds to financial strain and stress.

I often advise my clients to seek states where Section 8 vouchers are processed more quickly. However, not everyone agrees, as they may have strong ties to a particular city.

I now see that there have been some notable innovations and improvements to the Section 8 program in Michigan. Landlords are encouraged and the application process is simplified, making the program more accessible. Michigan even now has financial incentives and support for landlords. I believe that this certainly expands the choice of housing and opportunities for participants.

In addition, Michigan has made progress in streamlining the application process for Section 8 assistance. Online portals and expedited review processes have helped reduce wait times and bureaucratic hurdles, ensuring that individuals and families get the support they need faster.

In addition, support services for Section 8 participants were expanded, providing access to job training, educational programs, and childcare assistance. These services not only meet immediate housing needs but also provide participants with the opportunity to achieve long-term stability and self-sufficiency.

Through these innovations and improvements, Michigan’s Section 8 program is working to break down barriers and create opportunities for individuals and families in need. As a social worker, I am proud to be part of this ongoing effort to build a more inclusive and equitable society.

Considering development trends and processes in construction, I believe that it is very important to conclude partnership agreements with developers to increase the supply of affordable housing. After all, government incentives for construction and reconstruction provide more opportunities for both landlords and tenants.

Stakeholders in Michigan, including state and local governments, housing authorities, advocacy groups, and community organizations, must remain vigilant in monitoring and responding to changes in federal policy to uphold the efficacy of the Section 8 Program in meeting the needs of vulnerable populations within the state.

Through collaborative efforts and advocacy at both state and federal levels, policymakers can shape policies that foster the long-term success and sustainability of Section 8 in Michigan.

FAQs

Who qualifies for Section 8 housing in Michigan?

In Michigan, Section 8 housing assistance is available to low-income individuals, families, seniors, and individuals with disabilities who meet HUD’s income requirements. Priority is often given to those with the greatest need. Applicants must contact their local Public Housing Agency (PHA) to apply.

How long does it take to get Section 8 in Michigan?

The time it takes to get Section 8 housing in Michigan can vary widely depending on factors such as local demand, funding availability, and individual circumstances. Generally, the application process can take several weeks to several months or even longer.

Does Section 8 pay utilities Michigan?

Yes, in Michigan, Section 8 housing vouchers typically cover a portion of the rent and may also include allowances for utilities such as electricity, gas, and water.

What is a housing choice voucher in Michigan?

A Housing Choice Voucher (HCV) in Michigan is a form of federal rental assistance, commonly known as Section 8, that helps eligible low-income individuals and families afford privately-owned rental housing. Recipients can choose their housing, and the voucher subsidizes a portion of the rent. The program is administered by local Public Housing Agencies (PHAs) under HUD guidelines.

How to find low income housing in Michigan?

To find low-income housing in Michigan, contact local housing authorities, use online resources like MichiganHousingLocator.org, explore non-profit organizations, check government programs such as LIHTC, utilize social services, and network for referrals.

Can I transfer my Section 8 to Michigan?

Yes, it’s possible to transfer your Section 8 voucher to Michigan if you currently hold a Housing Choice Voucher (HCV) from another state.

How do I get help with first month rent and security deposit Michigan?

For assistance with the first month’s rent and security deposit in Michigan, individuals can contact local charities, churches, community action agencies, state and local government programs, housing authorities, non-profit housing organizations, and emergency assistance programs.

How long do you have to pay rent in Michigan?

In Michigan, the duration for which you have to pay rent is typically outlined in the terms of your rental agreement or lease contract.

What is the most a landlord can raise rent in Michigan?

In Michigan, there is no statewide limit on how much a landlord can raise rent for properties not covered by rent control ordinances. However, landlords must provide tenants with proper notice before increasing rent. Typically, this notice period is 30 days for month-to-month rental agreements and as specified in the lease for fixed-term leases.

Conclusion

Section 8 housing in Michigan serves as a vital lifeline for low-income individuals and families, providing them with safe and affordable housing options. Through Housing Choice Vouchers, administered by local Public Housing Agencies, eligible residents gain access to privately owned rental units while receiving assistance to make rent payments manageable.

While navigating the complexities of Section 8 housing can be challenging, the program remains a beacon of hope for those striving for stability and security in their housing situations. As Michigan continues to address housing affordability issues, understanding and supporting Section 8 housing initiatives is crucial for fostering inclusive communities and promoting economic opportunity for all.

This article provides such a clear and thorough explanation of Section 8 housing in Michigan! I really appreciate how it breaks down the eligibility, application process, and payment structure so comprehensively. It’s great to see detailed information that can help people understand and navigate the system more effectively. The practical insights into how vouchers work and how they can be used to find suitable housing are incredibly helpful. Kudos to the author for making this important topic accessible and informative!